The Market is Pricing in More Rate Hikes

economyThe news is littered with talk of rate hikes and inflation, and rightfully so! Inflation remains stubbornly high and barely cooling off, even after the Federal Reserve has hiked the Fed Fund Rate to 5.08% at a very fast pace.

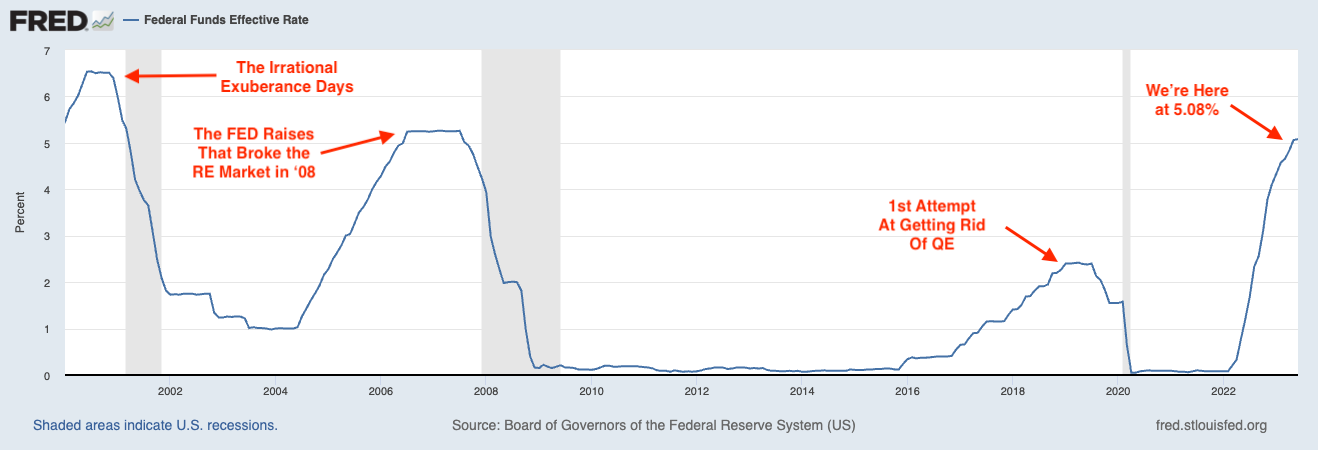

If you take a look at this chart of the Fed Fund rates, going back to 2000, you’ll notice that a recession has always come after interest rate hikes. Always.

This is contrary to what we hear in the news. I hear talk of “side-stepping” a recession or we’re in for a very soft landing. I still believe that we’re in for a recession, I just don’t know when the Fed will break the market’s back but one thing is for certain. There will be at least two more rate hikes.

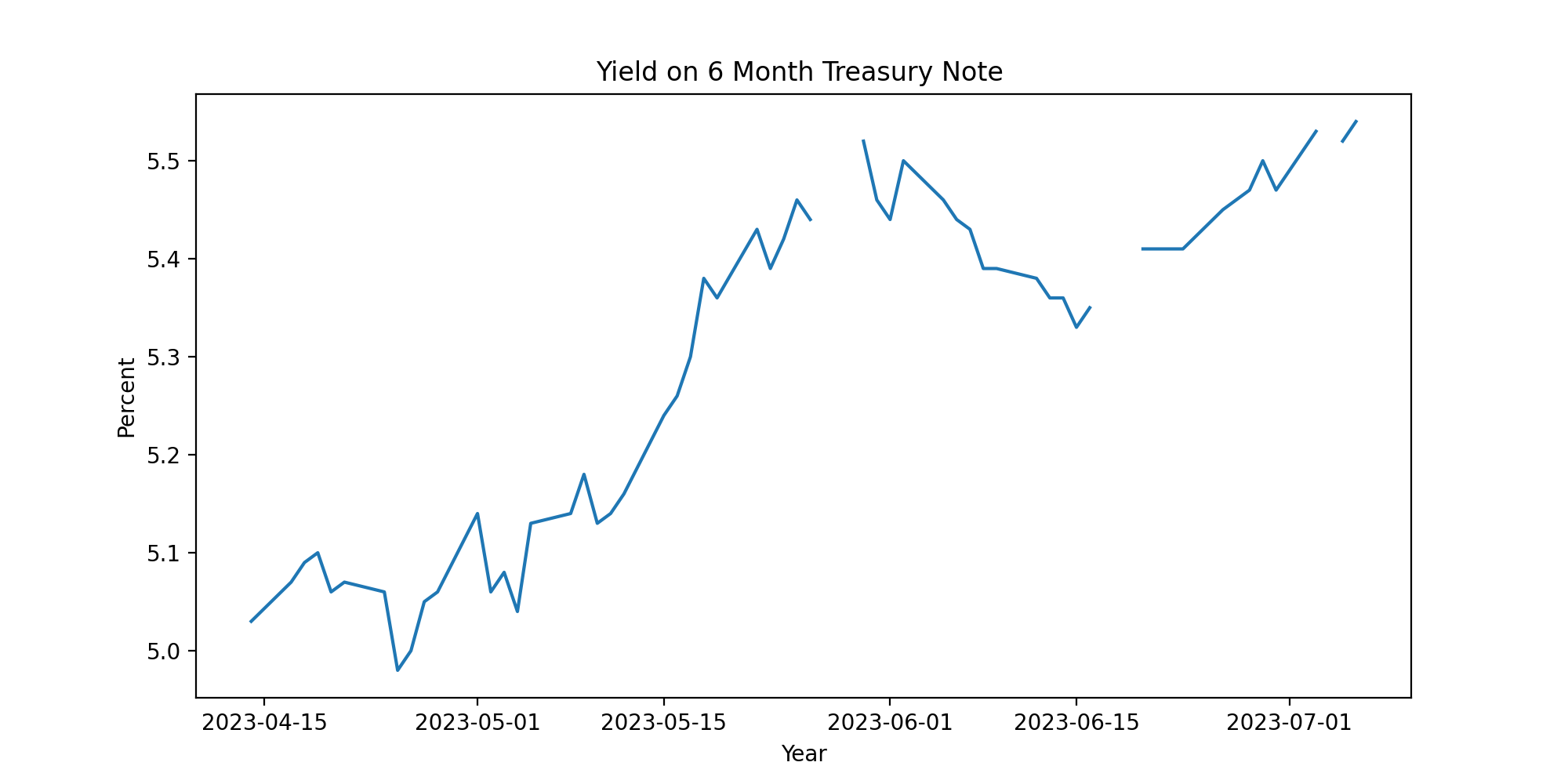

That is if you believe the 6-month and 1-year Treasury notes. The 6 month yield sits at 5.54%, which is almost 0.5% above the Fed Fund Rate.

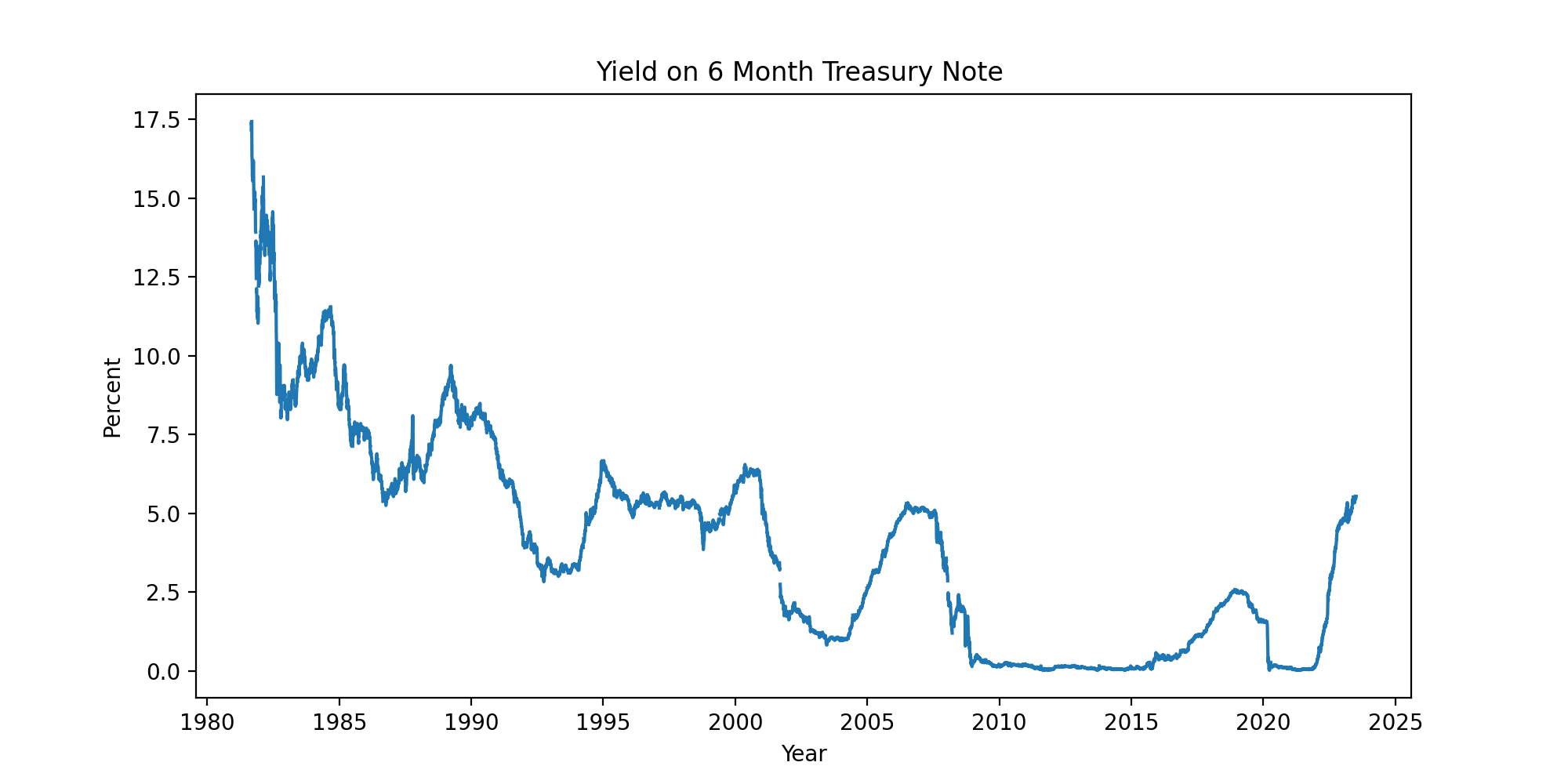

If you zoom out of this window to a larger chart of the 6-month yield, you’ll see that it mimics the Fed Fund rates quite nicely.

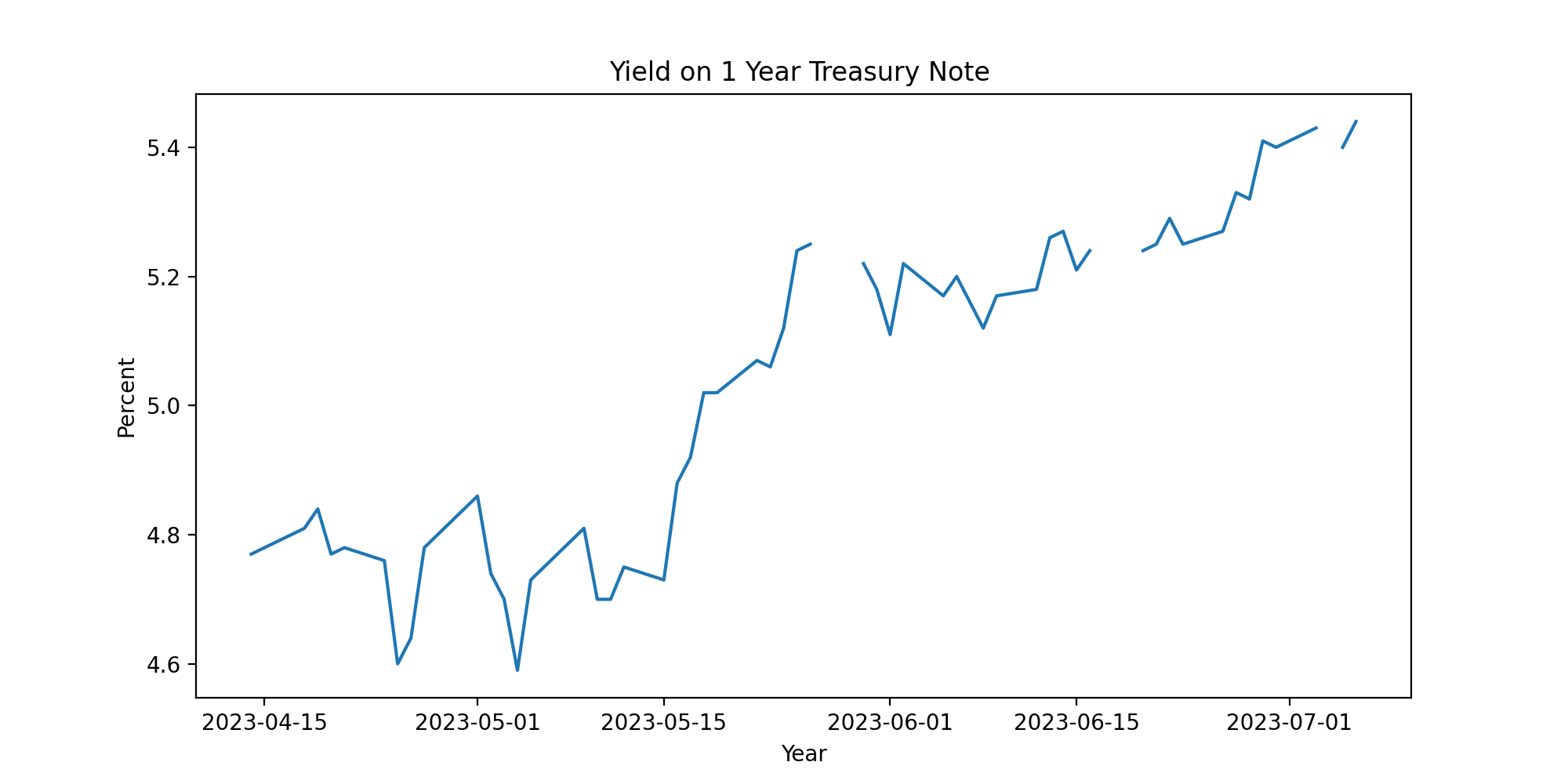

We see this pattern repeat itself on the 1-year Treasury note, which is currently at 5.44% (higher than the Fed Fund rate).

Both the 6-month and 1-year notes are indicators that show market participants expect higher rates in the near term. With the July interest rate hike of 0.25% all but priced in, these moves in the bond market are pointing toward at least one more interest rate hike after July.

When will a possible second hike happen? That’ll depend on what we see in the CPI and core CPI numbers that are coming out this week. The consensus is that they will be lower but I’m interested in by how much. I think the consensus might be a bit off this time around.

As I mentioned in my TikTok, inflation might be cooling a bit, but it remains high for gas and food. I found that out during our short camping vacation in Delaware. Granted, we were down at the beach in the middle of summer but things were more expensive than I expected. This is why I’m also watching what the [Consumer will do too(https://www.neuralmarkettrends.com/watching-the-consumer/)].

We’re in for a wild ride this year, so hang on tight!