NVDA Beats Earnings Again - By a Lot

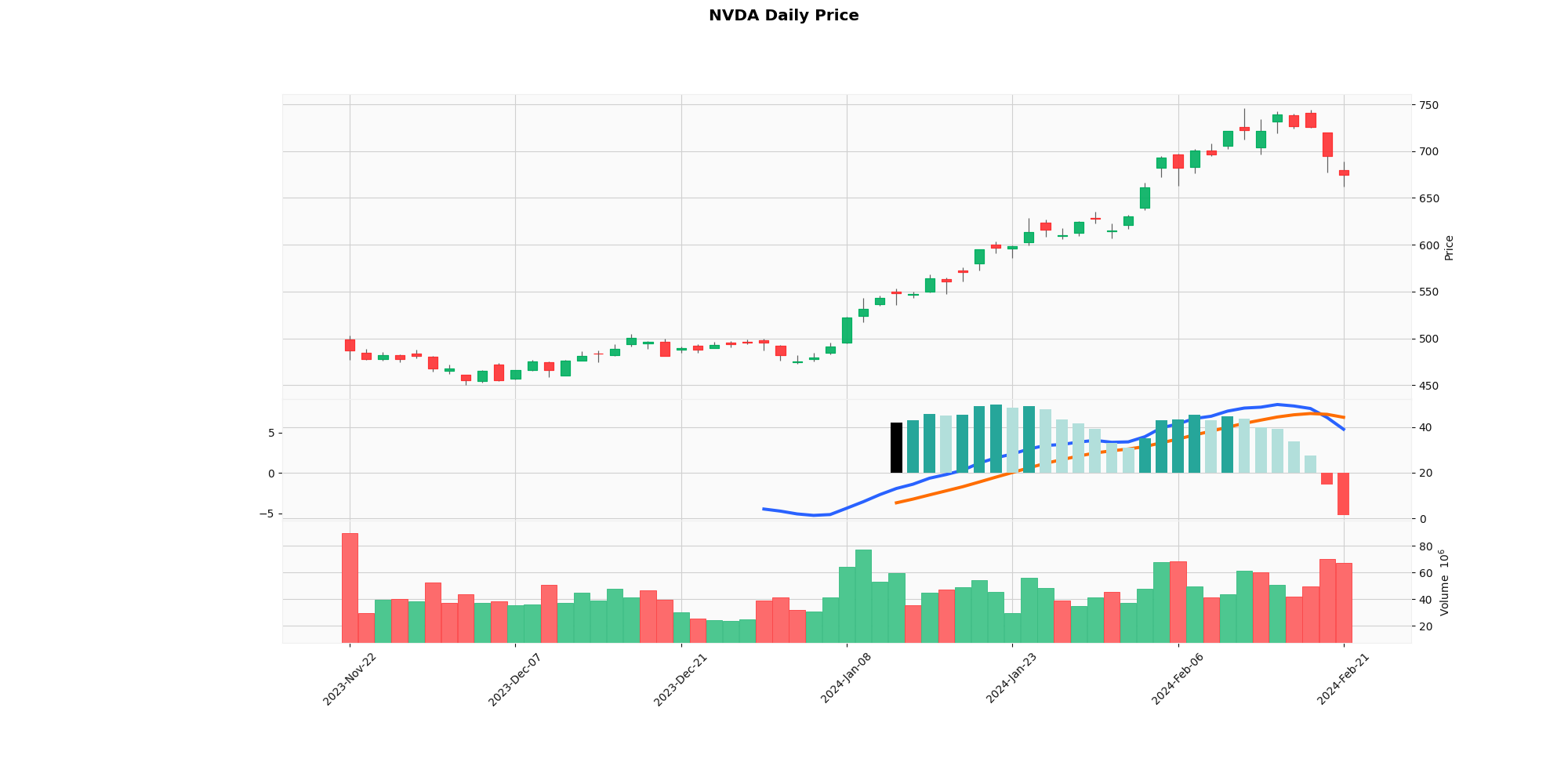

NVDA Stocks Trading InvestingThere are a few rules I follow religiously if I’m focusing on trading a short term horizon. I always sell half when I had an amazing run and let the other half run, and I always reduce risk right befor a stock’s earning call; even if the call is expected to be good. I ended up closing all my NVDA positions on Tuesday.

In the case of NVDA’s earnings yesterday, all evidence was pointing to a great earnings call and they delievered. NVDA earnings beat everything forecasted and they gave some strong guidance for the quarter ahead. As I write this post, it’s trading up almost $100 in the pre-market.

Am I mad that I sold off all my NVDA positions before the earnings call? No, not at all. I locked in profits and you can never go wrong by locking in profits. There have been times when I carried too much risk going into an earnings call and been burned.

So what’s my plan for NVDA today and through the next quarter? I’m going to buy high and sell higher, that’s the plan. Trend following works and it’s a no brainer in the case of NVDA.

People might wonder why would I buy NVDA with a P/E ratio of around 90, isn’t it over valued? Yes, it’s very overvalued in my opinion. Is the market too high and over valued? Yes, the market sure is but I can’t let my bias creep into what I want to happen in the market. All I can do is trade what’s in front of me and attempt to extract money from my bets.

Disclosure: No positions in NVDA at the moment.