Real Estate Market Crash Delayed

EconomyIt’s not a secret that I watch the Real Estate market like a hawk ever since we became landlords, now ex-landlords. I’ve written about it before but we were good landlords and kept the house in good condition, the rents low, and made sure our tenants were safe. That’s not to say we had headaches and the occasional problem tenant but for the most part, I think we did good.

We sold our rental property in September 2022, which appears to be awfully close to the top of the Real Estate market. We were lucky because I don’t believe you can ever time buying at the low and selling at the top.

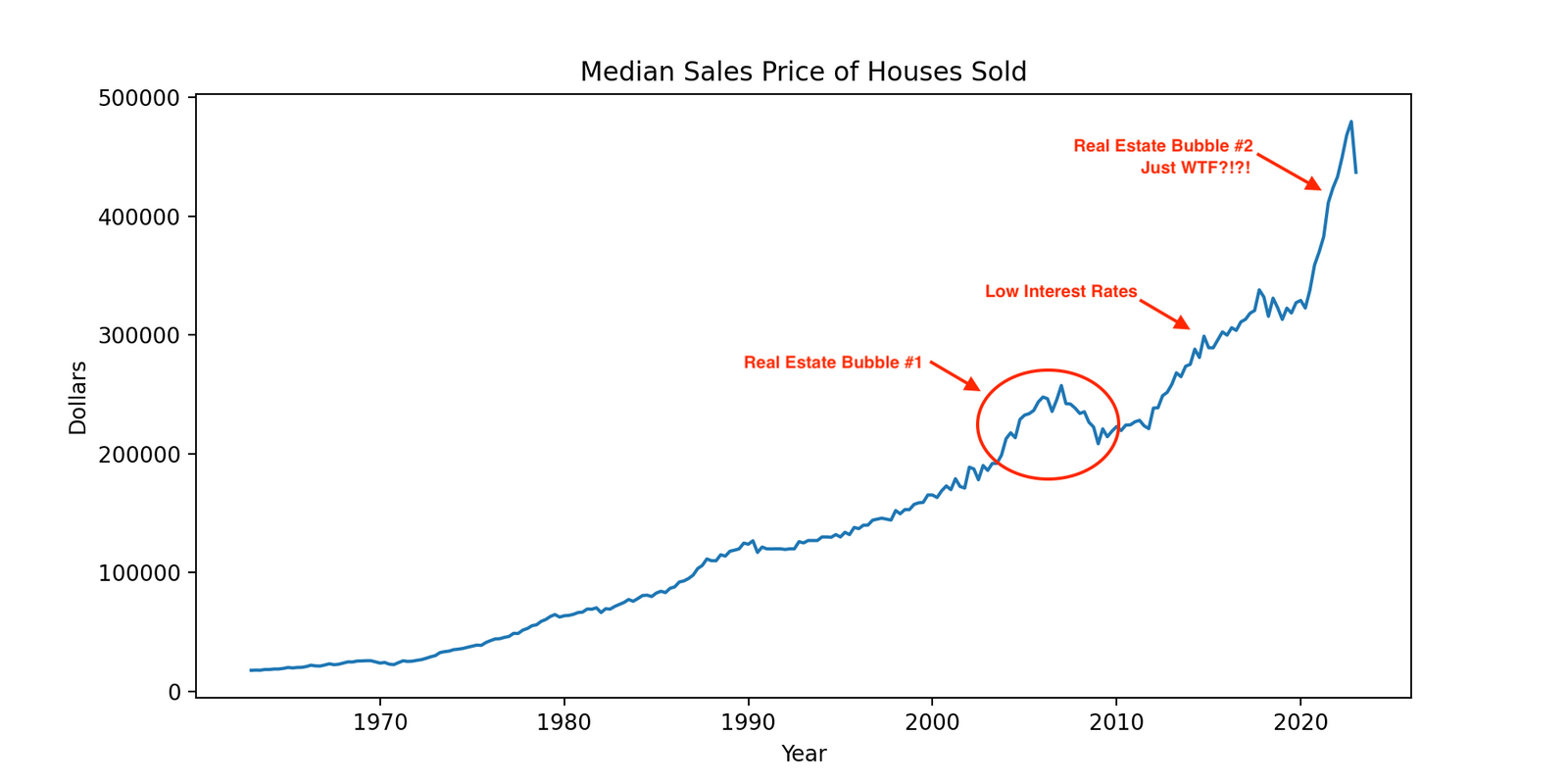

The Median Sales Price peaked at $479,500 back in September 2022 and has since dropped to $436,000 (April 2023). I thought I started to see cracks appear in the real estate market back then considering that drop was 9.07%, a big change.

I thought we’d see a cooling off of the real estate market in the face of rising Fed Fund Rates, instead, we’re seeing prices going up.

Real Estate is in a bizarre price appreciation trap right now that will, at some time in the future, come crashing in on itself. The problem with my prediction? I have no idea when it’s going to happen because of what’s happening.

Here’s what I believe led to this massive real estate bubble we’re facing:

Interest Rates Were Too Low For Too Long

Back when the Real Estate market crashed in 2007/2008 and nearly took the entire global economy with it, the Federal Reserve responded by lowering its Fed Fund Rates to nearly zero.

After the mortgage backed securities (MBS) were unwound and creditors once again found stability, they started lending again. Money started to flood back into the system over the years and the real estate market began to appreciate once more.

Back then you had a lot of supply due to foreclosures and these properties were gobbled up first.

COVID Pandemic Relief Money Floods Market

The COVID Pandemic was an almost unprecedented event, something similar happened on 1918 with the Spanish Flu but that was a time where our economies weren’t so integrated with the world. In some cases the effect of shutting down the global economy was unprecedented, but a pandemic raging through out country wasn’t, it just happened long ago.

Former President Trump and Congress responded with the CARES Act to pump $2 Trillion dollars into the economy via PPP loans. This did help but because of the lack of oversight, a lot of that money was used fraudulently and it’s believed that a lot of it ended up buying real estate.

The list of various CARES Act schemes is endless and astounding: the couple who scammed some $20 million off unemployment insurance while living as high rollers in Los Angeles; the Chicago man under indictment for selling bunk Covid tests and allegedly raking in $83 million (he has declared his innocence); the Florida minister who the feds allege faked the signature of his aging accountant, suffering from dementia, to steal $8 million in PPP loans (in a twist, the pastor has been locked in a legal battle to determine whether he’s psychologically fit to stand trial). One particularly loathsome and effective plot: offering fake meals to underprivileged children in Minnesota to reel in a whopping sum of $250 million. Noted serial liar George Santos allegedly got in on the act: He was charged with receiving unemployment benefits while he had a six-figure job in Florida. (Santos has pleaded not guilty.) Other examples are admittedly funny: A guy named John Doe got unemployment money, as did someone named Mr. Poopy Pants, and so did a person going by the name of Diane Feinstein, presumably not the senator from California. - via Rolling Stone

Now add in another $3 Trillion dollars from the Biden administration and our economy was awash with money looking for a home. The AP News estimates that “fraudsters potentially stole more than $280 billion in COVID-19 relief funding; another $123 billion was wasted or misspent.”

If we were to peel back all the layers of where all the misspent money went, I’m sure we’d find that some of it was spent on real estate, as the Jolloffs did (emphasis mine).

The Jolloffs then used the money to purchase three pontoon boats, real estate in Indiana, home furnishings, outdoor kitchens for their homes, a 2020 Polaris utility vehicle, jewelry, and two dogs, investigators said. The couple also purchased a furniture business in Indiana and a landscaping business in Florida, which had no connection to the businesses for which the couple had obtained COVID relief funds, officials said. - via Portland Press Herald

High Interest Rates, Low Supply

Ironically, high interest rates should cool off house prices but in this case, all the home buyers of `yore are sitting tight with their long-term mortgages at 3%. That’s taken a ton of houses off the market and reduced the available supply causing, you guessed it, higher prices.

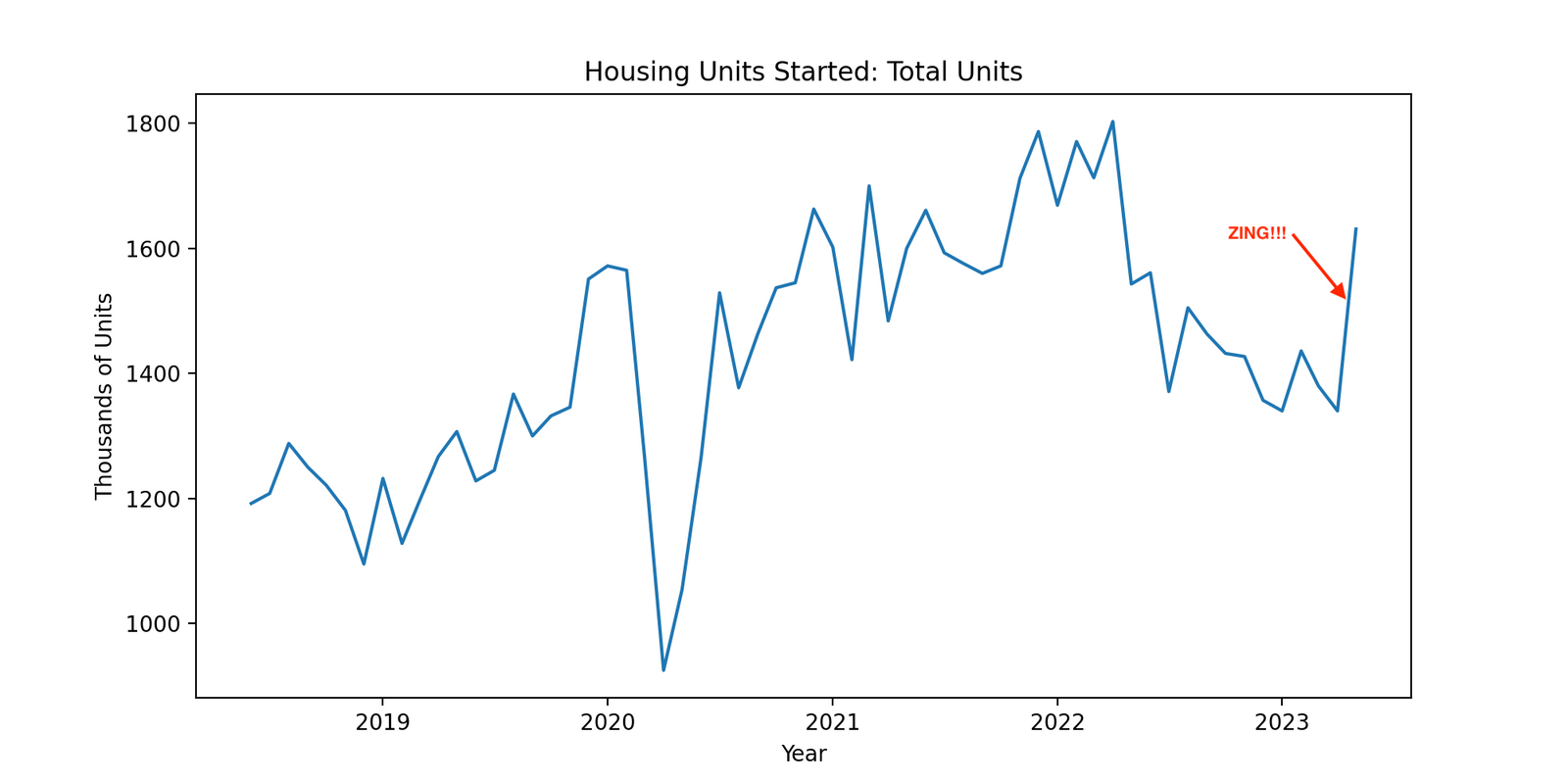

The first-time home buyers of today can’t catch a break! Or can they? Homebuilders have responded by picking up the pace of new housing starts back in May 2023. I can’t wait to see what the June 2023 data shows.

Millennials Are Drowning in Debt

Wait! There’s more! Millennials are drowning in debt to the tune of $4 Trillion dollars! How are they going to afford these record-high prices? Newsflash, they’re not going to be able to unless they have help from family or a miracle happens.

Sadly, they can’t “bank on” help from family members because they’re in bad shape as well. This is why Millennials and first-time home buyers are hoping for a real estate market crash. They’re willing to pay reasonable prices for quality assets, not be shackled into servitude for life.

End Notes

The real estate market crash has been delayed, for now, until we get inflation under control. Granted, the homebuilders are trying to fill the niche for the demand but these market imbalances are always going to correct, it’s just not when you want or expect them to.

I will be watching what the consumer will be doing over the next few months, what the Federal Reserve is going to do with interest rates, and watching the CPI numbers this week.

As I wrote before, hang on! We’re in for a wild ride!