Inflation Keeps Cooling Except Real Estate

Economy Real EstateThe CPI and PPI numbers came in this week and all the economists and market players were excited that JPOW’s tightening might be coming to an end. On the surface, the numbers looked great but when you dig deeper into them there’s something in there that’s still concerning.

The Producer Price Index (PPI) for June 2023 advanced only slightly for goods, it just increased 0.1% while services climbed 0.2% higher. It looks like all the interest rate hikes are working their way into the economy.

The CPI and Core CPI numbers were better too but something is afoot with those numbers. The Consumer Price Index for June 2023 came in at 0.2% higher, which was less than the forecast of 0.3%. Everyone rejoiced at this headline number and the market players quickly changed their bets on how many more rate hikes the Fed and JPOW will do.

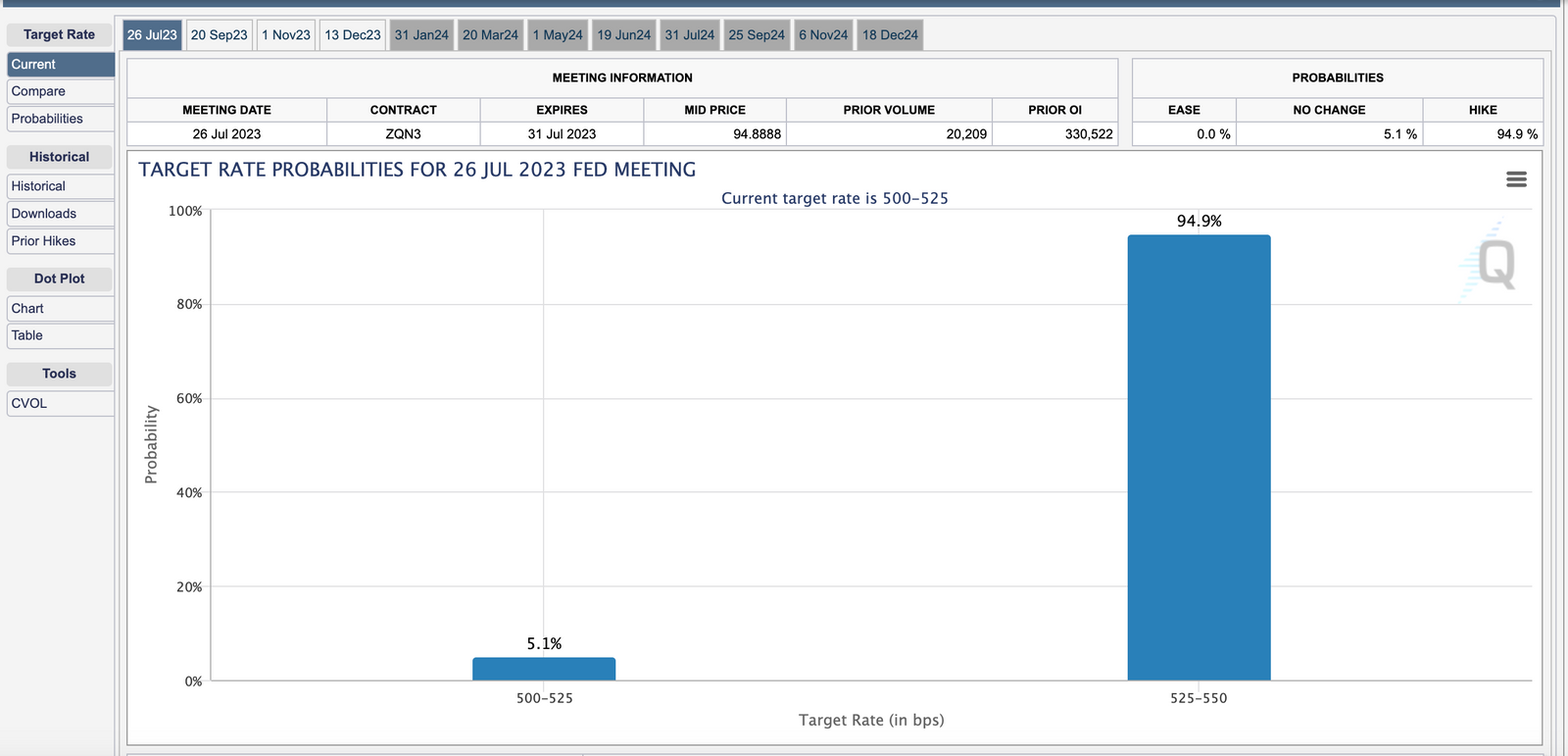

Right now the odds of a rate hike of 0.25% in July are at 94.9%. While this rate hike was already priced in, the good CPI numbers were confirmed with a positive outlook. Everyone believes that the tightening cycle could be over or that maybe at least one more hike in October/November might happen. This sentiment, of course, pushed stocks higher.

However, if you dig into those CPI numbers, shelter was the biggest driver of that 0.2% increase. Without it, the CPI would’ve contracted. This is the big nut to crack for the Federal Reserve, how do you bring down the red-hot and stubborn real estate market?

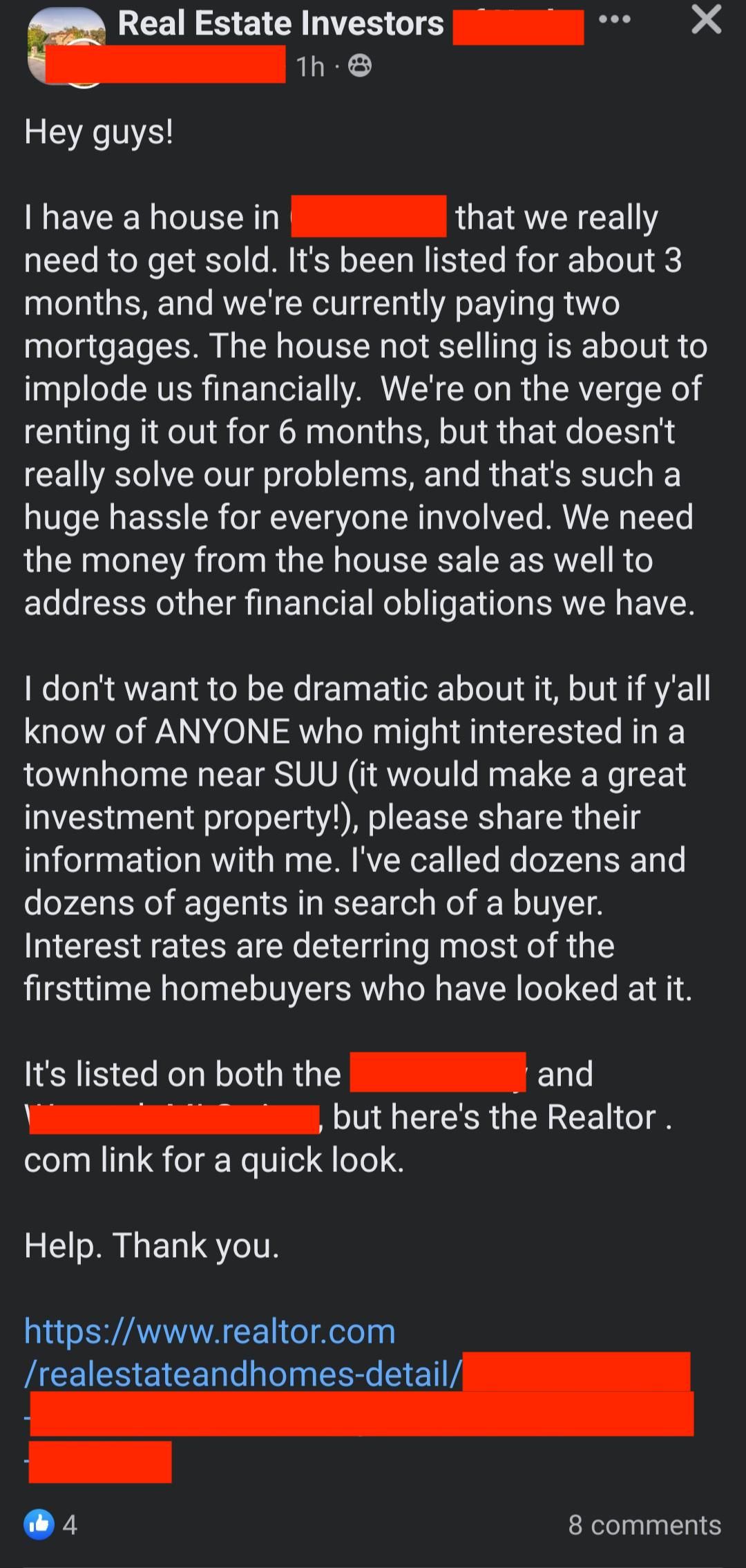

Granted, cracks are emerging in real estate. I’m starting to read social media posts where some real estate investors are desperate to unload their properties. It’s starting to smell like 2007/2008 all over again.

It reminds me of the time in 2006 when members of the Real Estate Investing club I belonged to started buying up pre-construction Condos in Florida. They laughed at any mention of a Real Estate bubble during their weekly “investor calls.” Those same people called me to see if I wanted to buy one or more of those units when they saw the market contract violently.

I’ve written about the price appreciation trap we’re in for Real Estate and how the Real Estate Crash is Delayed, but make no mistake it’s coming.

I believe that JPOW will tighten one more time after July 2023, at the least. The 6 months and 1-year treasury yields have eased back slightly and I will be watching them closely over the next few months, but with CPI and PPI numbers starting to respond he’s going to take aim at the shelter part of the CPI (aka the Real Estate market).

Batten down the hatches, this could get rough.

Stay In The Know...Get Our Newsletter!

"A new newsletter signup is coming soon."