Weekend Market Report

Good Sunday Morning. In this weekend briefing we review the gold and silver market, provide price forecasts, and review a recently closed trade and offer up a new trend following opportunity.

The gold and silver markets had a strong rebound this week with prices away from their intermediate consolidation areas. Silver closed strong and just over the key psychological price of $25.00 where gold closed above $1,950. Both these precious metals were buoyed by the tamer CPI and PPI reports that hinted the Federal Reserve might be pausing their rate hikes after July.

Both gold and silver trends remain down and the price action for both precious metals over the next few weeks will provide clues if the trend will flip higher. The market is digesting the next moves of the Federal Reserve and just how high inflation really is. It should be noted, just because the CPI and PPI reports were less than forecast, inflation is still high overall. It has NOT come down by any means, only that it's accelerating less.

We provide our gold price and silver price forecasts below:

Silver Market

Some key areas of support (green) and resistance (red) for silver are:

- Resistance at $23.83 and $25.06

- Support at $20.81

Last week's silver price forecasting prediction pointed toward a higher closes for silver, the model was correct. Next week's silver prices are forecast to close higher by Friday, if silver can take out the resistance at $25.06.

Gold Market

Some key areas of support (green) and resistance (red) for gold are:

- Resistance at $1,926.40

- Support at $1,808.80

Last week's gold price forecast was for a lower close, the model was wrong. The new forecast for the gold price forecasting model is for a lower close next week.

Sold RCL

This week we said goodby to our poisition in Royal Carribean Group (RCL) when our volatility stop was hit. This happened right on the day the CPI report came out and I'm not sure what to make of all it just yet. It doesn't matter, the market took me out and I closed out a long term holding with a profit.

Looking at PAG

Penske Automotive Group (PAG) showed up on one of my all-time new price highs scanner earlier in the week. It looks like it's forming a strong trend higher. I love trend following because it's the market telling you what's hot. You can't keep your eye on everything in the market and its an easy way to capitalize on these opportunitues. You just have to be smart and following all the appropriate risk protocols.

Since I found PAG and started keeping a lazy eye on it, it started to consolidate from it's all time high of $180.84. If I were to trade this dawg I would wait for it make another all-time high at the close and then go long the next day. I would religiously and faithfully enter a limit stop loss when I make the trade.

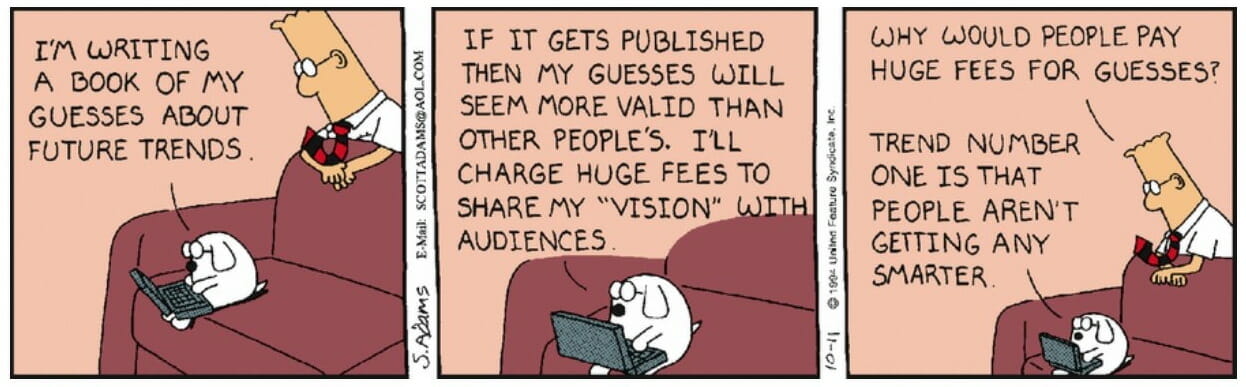

Learn About Trend Following

The following link I'm sharing with you is a goldmine. There's a ton of research and documentation about trend following and how profitable it can be and is, for that matter.

Most of the money I've made has been through trend trading and trading breakouts in the direction of the prevailing trends. Chairman Maoxian's famous Day-trading for Dummies posts would always point toward an asset's trend (up or down) and take the appropriate position. He rarely went against the grain and traded with the current trend.

Member discussion