The Magnificent Seven Stocks & Their Pending Crash

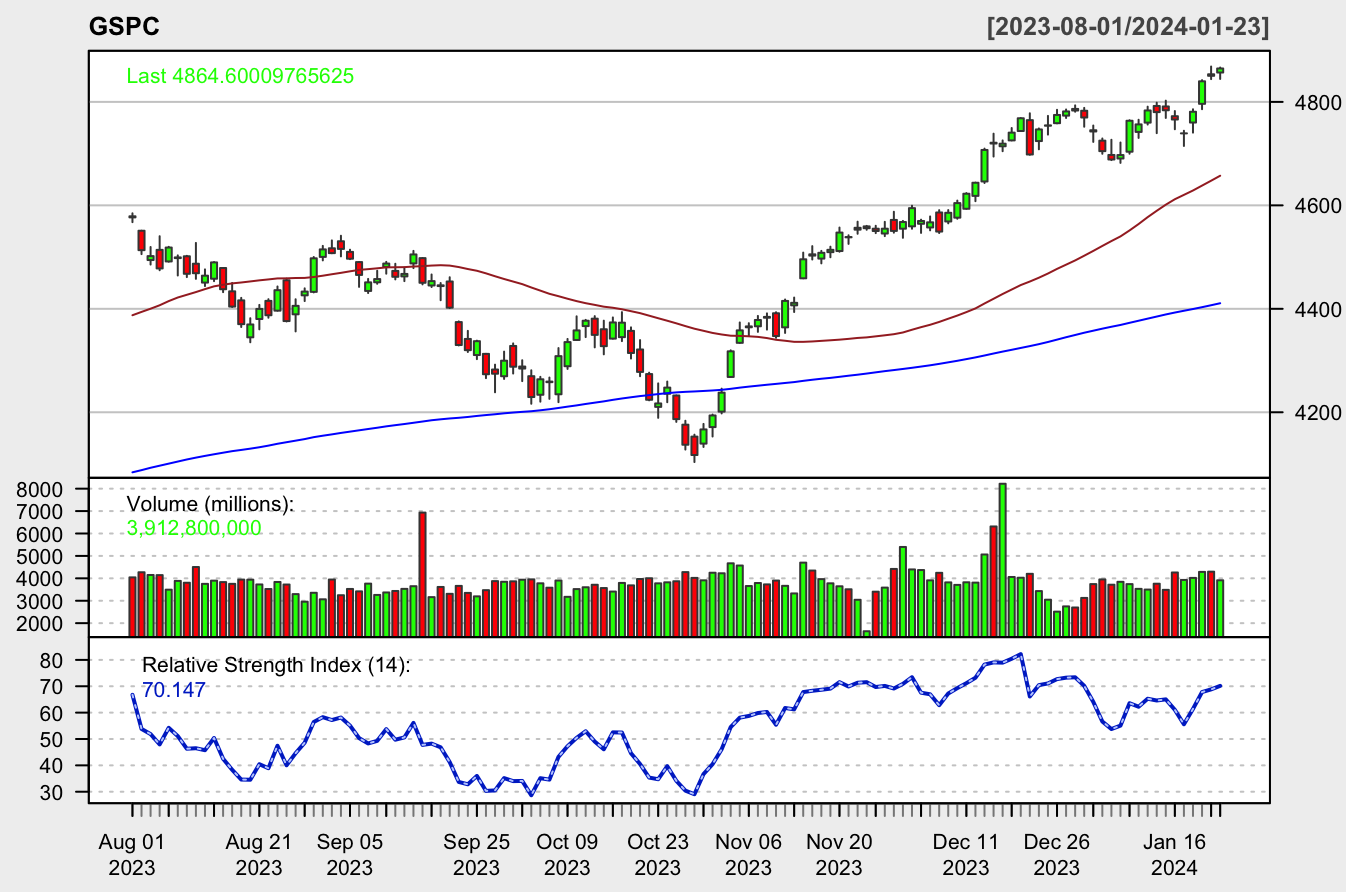

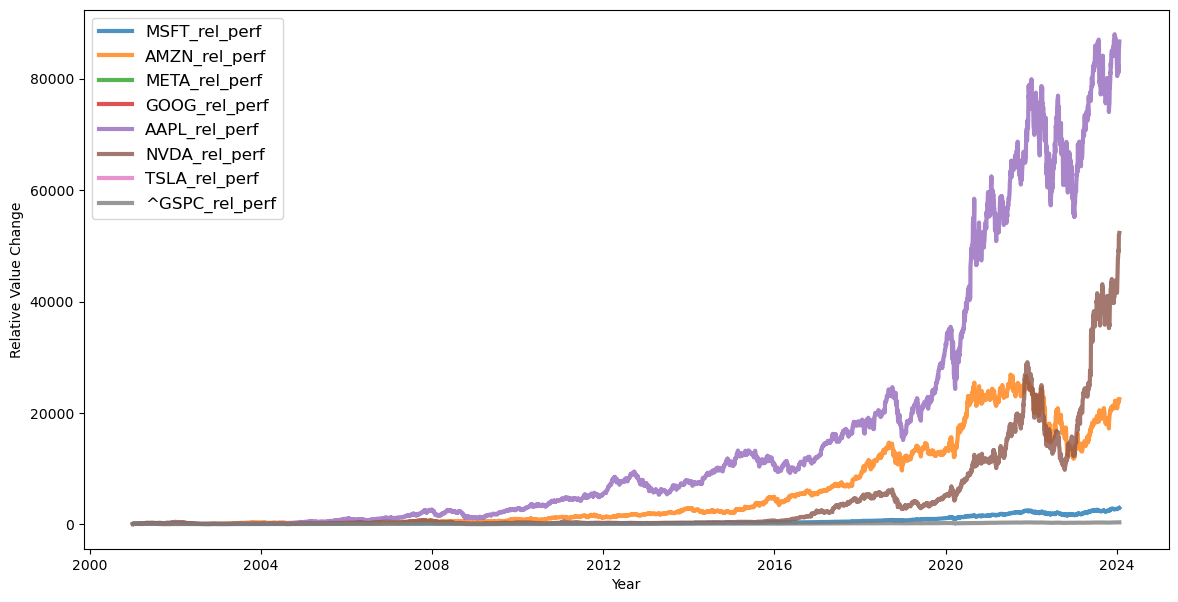

stocks markets crash NVDA TSLA AAPL META GOOG MSFT AMZNHistory might not repeat but it sure rhymes which seems to be the case here. I remember back in 2000, right before the Dot Com crash when four stocks, affectionately known as the “Four Horsemen” ruled technology. They generated so many gains with quarter after quarter of earnings growth. It seemed to go on forever until it didn’t anymore.

I’m talking about MSFT, INTC, CSCO, and Dell.. Today we’re repeating this same lunacy except it’s the Magnificent Seven that rule technology in nearly the same way. Their strong price action is pushing the S&P500 to new all-time highs, which I’m a BIG fan of, but I can’t help but wonder one damn thing.

If MSFT, AMZN, META, AAPL, GOOG, NVDA, and TSLA are the reason for new highs in the S&P500, then what are the other 493 stocks doing? Are they chopped liver or what?

Good question. I don’t know the answer but it’s making me nervous. I get it, technology is always a winner in the long run but I can’t help but wonder if there’s a repeat Dot Com crash on the horizon. These seven stocks can’t keep the S&P500 riding high forever. Eventually their earnings growth will stall and momentum traders will exit fast.

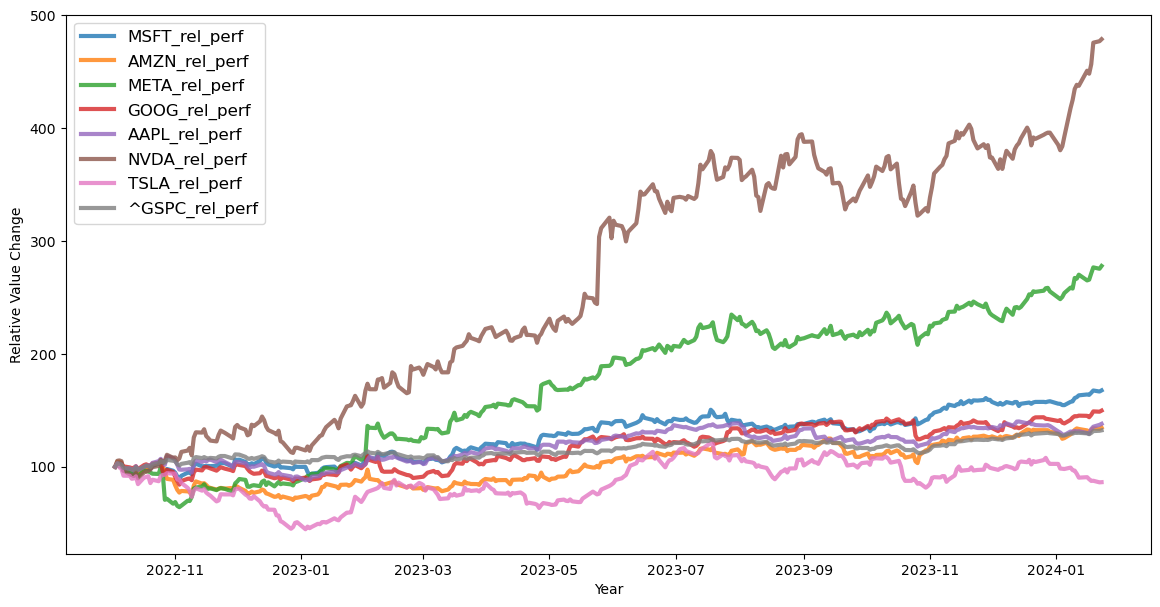

From the October 2022 low most have skyrocketed (I’m looking with disappointment at your TSLA).

From 2000, AAPL, NVDA, and AMZN rocked it.

That said, if you’ve been a long term holder of a few of these Magnificent Seven stocks, you’d be doing damn well. Hell, if you’re trend trader of NVDA you’d be making some sick coin. Still I always come back to what the other 493 stocks are doing because that’s the real economy.

Learn Stock Trading, Investing, and Risk Management

There are a handful of financial and trading books that have made a HUGE impact on my investments. If you want to trade and learn about money and risk management then I suggest you get the Van Tharp book. If you want just focus on long term investing, get the Random Walk Down Wall Street book.

Hell, get them both. I owe my wealth to what I learned in those books.