Trade Journal

Trading Journal NVDA AMDNow that I’m an active trader again I’m going to restart my semi-daily trading journal. I do this to keep myself sane spot where I make mistakes and learn to correct them.

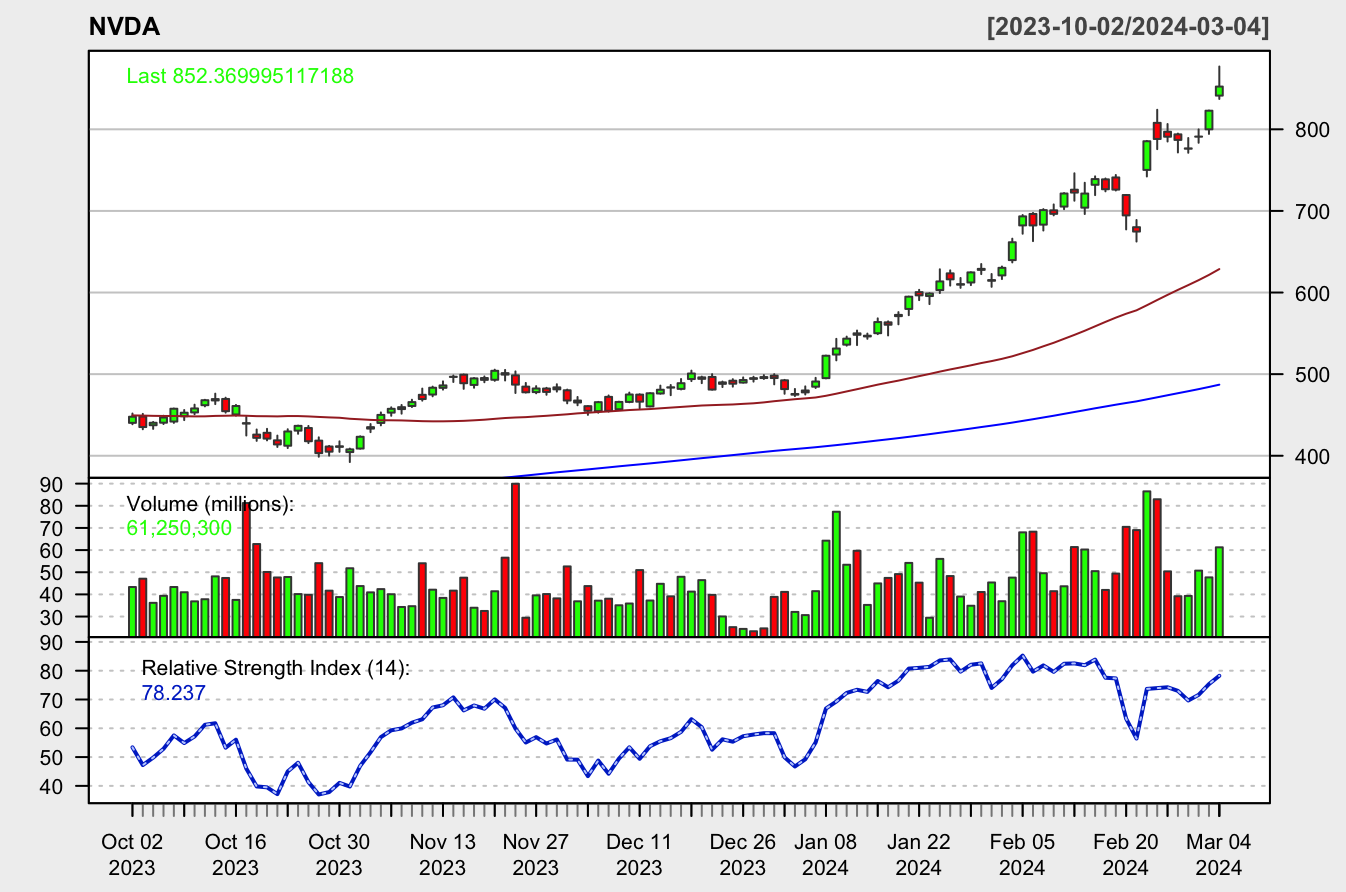

I’m long NVDA and it’s been a rocket to the moon. I got in around $750 and I expect it to hit $900 first before peaking out around $1,000. Traders love round numbers and I’m very wary of them because price action could fail around there.

I do not like what I’m seeing in NVDA right now, to be honest. The first gap up after earnings look like a normal big institution play, the second gap up feels like the Dentist Boomers, and that’s a red flag for me. I expect a pullback and a possible test of the $750 to $760 level. If that happens, I’m loading up on NVDA calls.

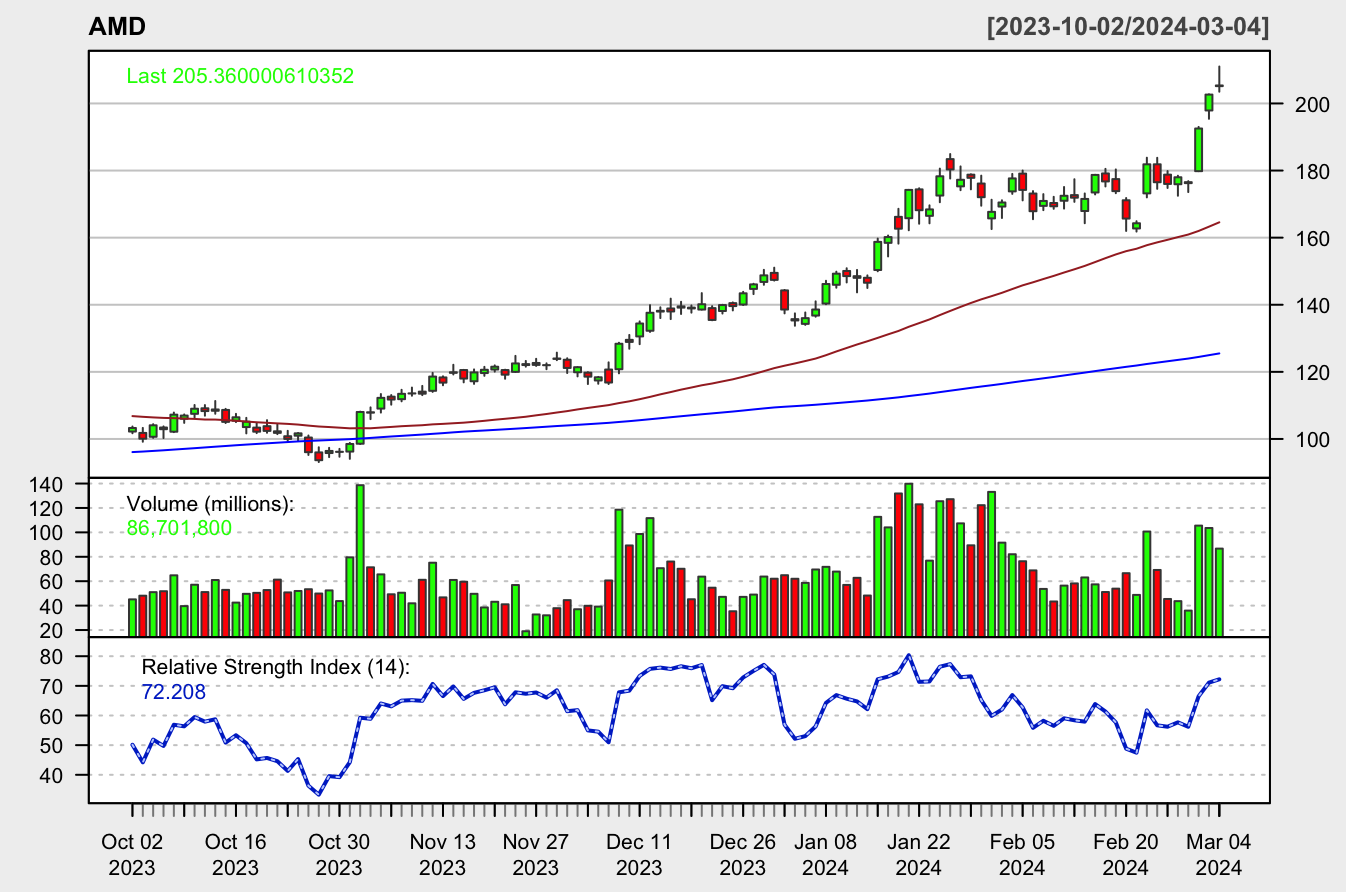

Speaking of calls, my AMD call (May 17, strike 230) has returned close to 50% as of yesterday’s close. AMD price action looks a lot like NVDA and I worry about a pullback. Have no fear, I have till May for it to hit $230 or at least get close to it.

The rest of my holdings are doing well because they’re classic buy and hold, but if the options pay off then I might change my trading strategy and focus on building wealth with buy and hold and turbocharge returns with options. Maybe. Everything is a maybe and subject to change.

You have to trade what you see, you can’t be biased.